Find out everything you need to know about investment

Find out everything you need to know about investment

As an independent financial services firm, we have access to a wide range of financial products, ensuring we can find the right solutions for you.

The timing of mutual fund investments is personal, but starting now is often advantageous. With current market conditions and strong potential for long-term growth, there's no better time to begin.

Products we can choose and customize for you

SU-SIP

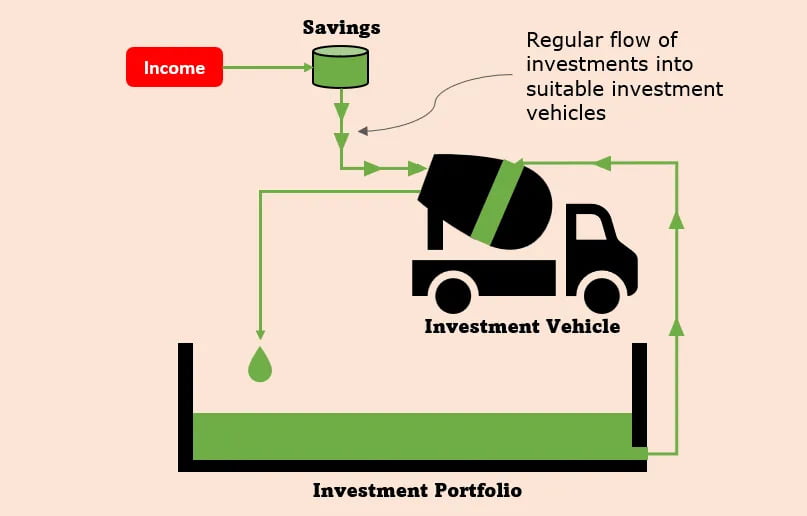

SIP, or Systematic Investment Plan, is a crucial investment mode known for its benefits such as the power of compounding, capital appreciation, and portfolio diversification. These features make SIPs an ideal choice for individuals aiming for long-term financial independence.

Our SU-SIP (STEP-UP Systematic Investment Plan) is uniquely crafted to accelerate wealth creation specifically for you. It's designed to harness the benefits of SIPs while tailoring the investment strategy to meet your financial goals efficiently.

Call us now to get your all new SU-SIP

Insurance products

We provide a comprehensive range of life and general insurance policies, alongside a variety of other financial products. At Opulence, we ensure you receive top-notch advice on insurance and financial solutions, helping you understand each product thoroughly. Our streamlined process saves you time, making it easier to select the most suitable product for your needs.

Contact us today to purchase or renew your insurance with confidence. Let us guide you towards securing the right protection and financial stability for your future.

We provide a comprehensive range of life and general insurance policies, alongside a variety of other financial products. At Opulence, we ensure you receive top-notch advice on insurance and financial solutions, helping you understand each product thoroughly. Our streamlined process saves you time, making it easier to select the most suitable product for your needs.

Contact us today to purchase or renew your insurance with confidence. Let us guide you towards securing the right protection and financial stability for your future.

Pre-IPO Shares

Pre-IPO share trading presents a strategic opportunity for long-term wealth building. These shares, being from companies not yet listed, are often available at lower prices compared to their listed counterparts. A key reason investors pursue Pre-IPO shares in India is the potential for significant gains once these companies go public.

To learn more about Pre-IPO shares or to initiate a purchase, contact us today. We can provide you with the information and assistance you need to explore this promising investment avenue.

Why should you invest in Bonds?

Bonds are renowned for providing fixed returns, enhancing the diversity of your investment portfolio, and generating a steady secondary source of income. A well-balanced portfolio aims to achieve an optimal mix of high-risk investments and conservative returns, thereby potentially converting market volatility into gains, especially in bearish conditions.

At our firm, we offer a variety of bond options including Central Government Bonds, State Government Bonds, Public Sector Bonds, and Tax-Free Bonds. Additionally, you can invest in fixed deposits with attractive interest rates from reputable institutions like Bajaj Finserv and Shriram Finance.

Contact us today to explore these investment opportunities and find the right bonds or fixed deposits that align with your financial objectives. Our experts are ready to assist you in making informed decisions for your portfolio.

Bonds are renowned for providing fixed returns, enhancing the diversity of your investment portfolio, and generating a steady secondary source of income. A well-balanced portfolio aims to achieve an optimal mix of high-risk investments and conservative returns, thereby potentially converting market volatility into gains, especially in bearish conditions.

At our firm, we offer a variety of bond options including Central Government Bonds, State Government Bonds, Public Sector Bonds, and Tax-Free Bonds. Additionally, you can invest in fixed deposits with attractive interest rates from reputable institutions like Bajaj Finserv and Shriram Finance.

Contact us today to explore these investment opportunities and find the right bonds or fixed deposits that align with your financial objectives. Our experts are ready to assist you in making informed decisions for your portfolio.

Comprehensive Investment

Our investment plans are meticulously crafted to align with your unique investment goals and risk tolerance. We offer a diversified portfolio that includes mutual funds, Pre-IPO stocks, bonds, fixed deposits, and other assets, catering to both growth and stability in your investments.

At our firm, we prioritize excellent customer service to ensure a seamless and hassle-free investing experience for you. Our dedicated team is committed to providing personalized guidance and support every step of the way, helping you navigate the complexities of financial markets with confidence.

Contact us today to explore how our comprehensive range of investment options can help you achieve your financial objectives effectively. Let us partner with you in building a robust and diversified investment portfolio.

FAQ's

A solution to your financial needs

Make your money work for you

Make your money work for you

Power Of Compounding

"The power of compounding allows your wealth to grow exponentially. Our special product, SUSIP, is designed to accelerate this compounding effect."